Business Insurance in and around Reno

One of the top small business insurance companies in Reno, and beyond.

Cover all the bases for your small business

State Farm Understands Small Businesses.

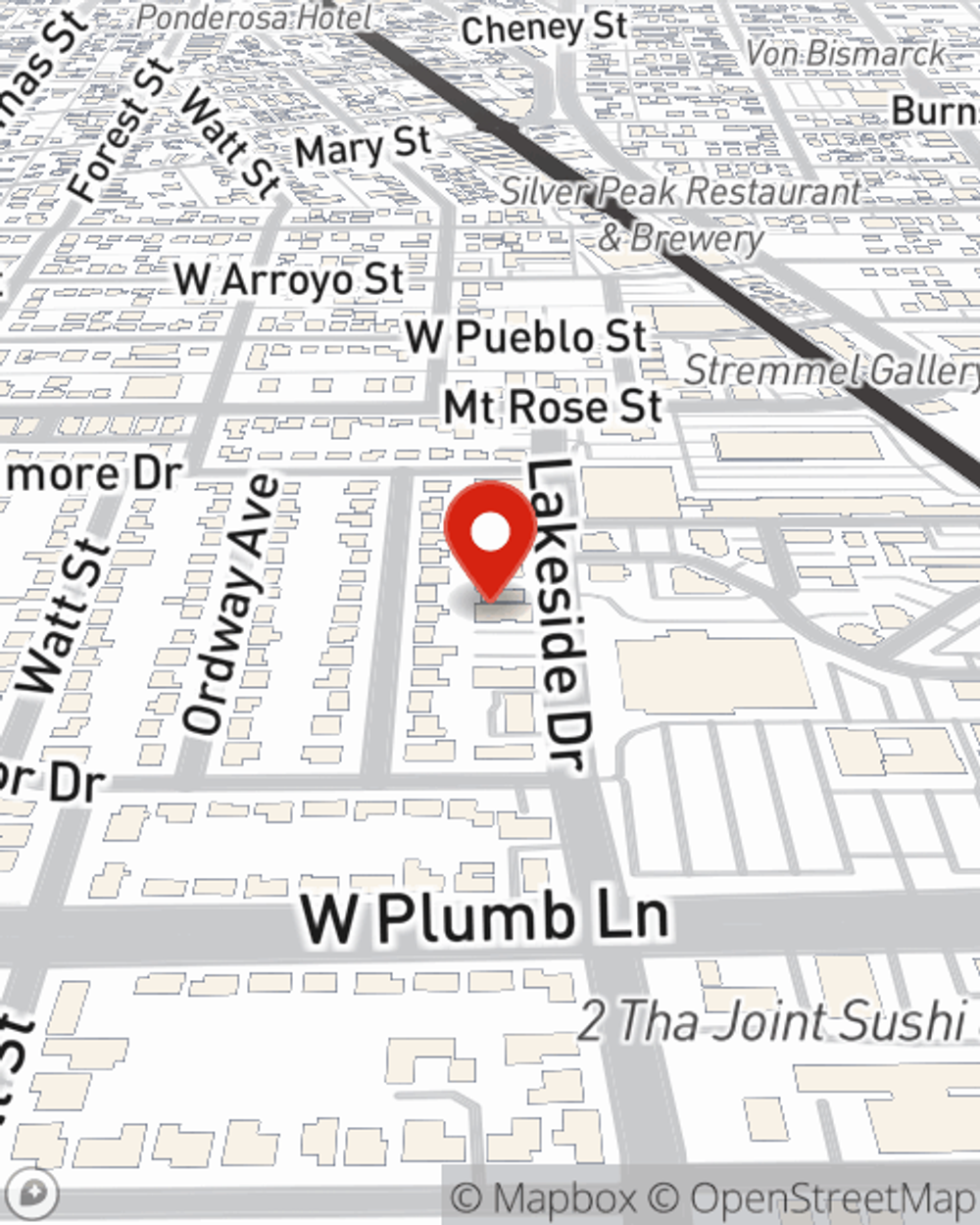

You may be feeling overwhelmed with running your small business and that you have to handle it all on your own. State Farm agent Christina Kantrud, a fellow business owner, understands the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

One of the top small business insurance companies in Reno, and beyond.

Cover all the bases for your small business

Insurance Designed For Small Business

For your small business, whether it's a bakery, a vet hospital, a travel agency, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like computers, extra expense, and business liability.

Contact the excellent team at agent Christina Kantrud's office to discover the options that may be right for you and your small business.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Christina Kantrud

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.